Saving Versus Spending

Saving money can sound like a strict lifestyle change, but it’s really just a way to give yourself more options. Sure, you don’t need to be perfect or extreme to benefit from saving, because even small amounts add up over time; however, it’s also important to enjoy the money you earn. Responsible spending is not the same as reckless spending, especially when you are thoughtful about what you buy and why you buy it. If you plan for your needs and keep your priorities straight, you can spend with less guilt and more satisfaction.

1. Handle Emergencies

Unexpected expenses happen, even if you’re doing everything in your power to avoid spending money. A solid emergency fund can cover car repairs, medical bills, or a sudden trip without panic. It also helps you avoid relying on high-interest credit.

2. Reduce Daily Stress

Money worries can sit in the back of your mind all day. Saving creates a buffer that makes problems feel more manageable. You might still have bills, but you’ll feel way more in control of the situation than if you have nothing saved up.

3. Avoid Debt

Saving gives you a way to pay for things without borrowing. That means fewer interest charges and fewer monthly payments eating up your income. Over time, staying out of debt can free up a lot of money for goals you actually care about.

4. Cover Big Purchases

Large expenses are easier when you plan. Saving for a phone, furniture, or a vacation keeps you from making rushed financial decisions. You get to buy what you want on your timeline, and saves you from having to make long-term monthly payments down the road.

5. Protect Your Future

Life changes, and your finances should be able to handle that. Saving helps you prepare for career shifts, moving costs, or family responsibilities. It gives you flexibility when your priorities have to change.

6. Feel More Independent

Having your own savings can reduce your need to lean on others financially. You can make choices based on what’s best for you, not what someone else can cover. That independence often feels empowering and lets you live your life to the best of your abilities.

7. Reach Personal Goals

Goals usually cost money, even the simple ones. Saving helps you follow through on plans like taking a course, starting a small business, or improving your home. When you set aside money consistently, your goals stop feeling like general ideas that you’ll never get to.

8. Prepare for Retirement

Retirement might feel far away, but planning early helps a lot. Even small contributions can make a meaningful difference over time. Saving now can reduce pressure later when you want more freedom in your later years.

9. Handle Job Changes

Work situations can change quickly, and not always on your schedule. Savings can help you get through a layoff, reduce stress during a job search, or give you the option to leave a bad situation. It is easier to make smart choices when you’re not in a desperate situation.

10. Enjoy Life More

Saving is not about depriving yourself; it is about making your spending intentional. When you have money set aside, you can say yes to plans without guilt or scrambling. It also makes fun purchases feel better because you’re not worried about the basics.

1. Life Is Happening

Waiting for the perfect time to enjoy yourself can turn into endless postponing. Spending a little on things that make your life better now is more than okay! You can still be responsible while giving yourself moments to look forward to.

2. You Earned It

You put time and effort into making money, so it only makes sense to benefit from it. Enjoying your spending is part of feeling rewarded for your work. When you spend intentionally, it can boost motivation instead of creating regret.

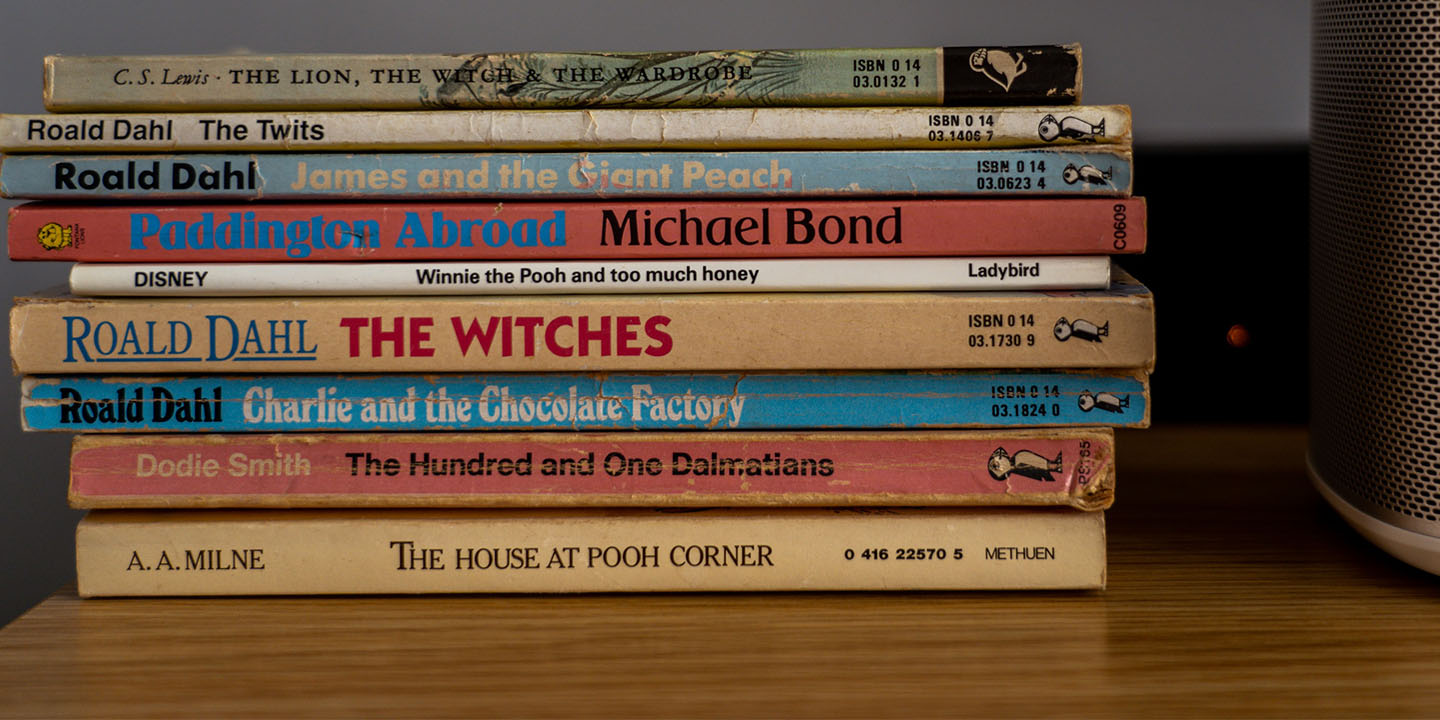

3. Experiences Matter

Money spent on experiences can create lasting memories. A trip, a concert, or even a great meal can feel worthwhile long after it’s over. If you budget for it, you can enjoy it without needing to stress out about credit card debt.

4. Comfort Has Value

Spending on comfort can improve your day-to-day life in real ways. Upgrading a mattress, buying supportive shoes, or making your home more functional can be a practical choice. You are not being lazy or wasteful for wanting to feel good.

5. Time Is Worth Paying For

Sometimes spending money saves you time and reduces stress. Paying for delivery, taking a ride share, or outsourcing a chore can free up your schedule. If it fits your budget, that can be a smart trade.

6. You Support Others

Spending often helps other people earn a living, especially when you buy from small businesses. Choosing local services, independent creators, or family-owned spots can feel good. Your money can do something positive beyond just benefiting you.

7. It Can Reduce Burnout

Constantly depriving yourself can make life feel overly restrictive. Allowing reasonable treats can help you stay balanced and avoid resentment. You’re more likely to stick with good habits when you give yourself breathing room.

8. You Learn What Your Priorities Are

Spending can help you figure out what you actually value. When you pay attention to what makes you happy versus what feels forgettable, you get clearer over time. That awareness can lead to better decisions and less wasted money down the road.

Riccardo Annandale on Unsplash

Riccardo Annandale on Unsplash

9. Generosity Feels Good

Treating friends, tipping well, or giving gifts can be genuinely enjoyable, as it strengthens relationships and makes shared moments feel more special. If you plan for it, generosity doesn’t have to cause stress.

Kira auf der Heide on Unsplash

Kira auf der Heide on Unsplash

10. Guilt-Free Is Possible

You can build a budget that includes fun on purpose. When your bills, savings, and goals are covered, spending becomes easier to enjoy. The goal is not to avoid spending, it’s to spend in a way that fits your life.