Saving money doesn’t have to be the gargantuan feat people think it is. Big or small, there are lots of things you can do to help save and avoid unnecessary purchases. Here are 20 of the simplest ways to do it.

1. Automate Savings

If you have a steady income, give yourself peace of mind with automatic savings. You can either speak with your bank or set it up yourself online—both routes allow you to control how much you’d like to save each month. That amount is then automatically added to your savings account, helping you save more in the long run.

2. Meal Prep

Meal prep is helpful in all kinds of ways. It helps you stay on top of a diet, saves time, and shaves down monthly expenses. Bulk buying from stores like Costco also allows you to grab a good serving of food, which helps you prepare well into the week.

Photo by Tina Dawson on Unsplash

Photo by Tina Dawson on Unsplash

3. Head to the Library

Quit buying books you’ve never read! Local libraries have endless choices, from the latest novel to classics you skipped in high school. It doesn’t make sense to buy a new book when you could just read it for free instead.

Photo by Trnava University on Unsplash

Photo by Trnava University on Unsplash

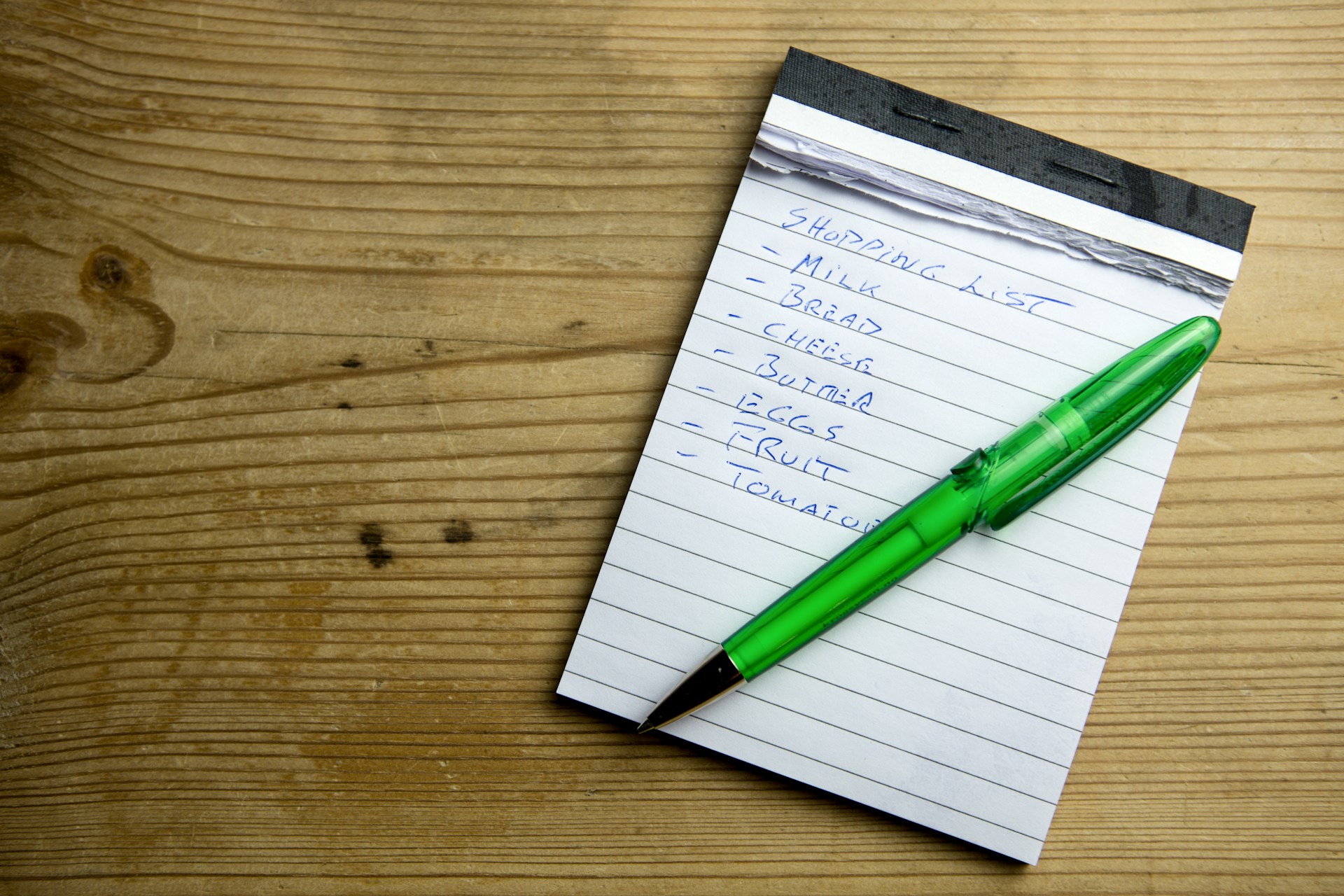

4. Shop With a List

No matter where you shop, bring a list with you. Lists keep you on target for what you actually need and eliminate pesky impulse buys. They also steer you away from duplicate purchases.

Photo by Torbjørn Helgesen on Unsplash

Photo by Torbjørn Helgesen on Unsplash

5. Nix Subscriptions

When was the last time you truly looked at your subscriptions? Chances are you’re paying for apps or services you don’t even use anymore! Go through credit card statements or use free apps to nix what you don’t want.

Photo by Mollie Sivaram on Unsplash

Photo by Mollie Sivaram on Unsplash

6. Limit Food Orders

Ah ah ah, put your phone down. We know it’s convenient, but stop ordering food so much—between the added fees, priority delivery, and driver tips, you spend a fortune. Not only that, but meal prep can easily solve this problem, including that of convenience! Readied meals are just calling your name from the fridge.

Photo by Erik Mclean on Unsplash

Photo by Erik Mclean on Unsplash

7. Wash in Cold Water

Washing clothes in cold water is a terrific way to save money, and it’s something you should invest in. It shaves more than you think off your bills, so give it a whirl.

Photo by PlanetCare on Unsplash

Photo by PlanetCare on Unsplash

8. Make Your Own Coffee

Just like you don’t need McDonald’s for lunch, you don’t need Starbucks for breakfast. Brew your own coffee to save some much-needed moolah. Even if you buy pump syrups for the house, it’s still more cost-effective.

Photo by Annie Spratt on Unsplash

Photo by Annie Spratt on Unsplash

9. Get Generic Items

Generic brands are not only often cheaper, but they’re usually the items that go on sale first. The difference between generic and name-brand isn’t a huge one either, so there’s no shame in the switch.

Photo by Tara Clark on Unsplash

Photo by Tara Clark on Unsplash

10. Shop Secondhand

Thrift stores and online marketplaces have just about anything. You can score affordable deals on clothing, decor, and even furniture if need be. Be wary of where you shop, however, as some thrift stores aren’t what they used to be, charging significant markups on certain items.

11. Affordable Entertainment

Movies cost an arm and a leg, restaurants charge a fortune…does anywhere have affordable entertainment? Well, yes! Libraries often have passes to galleries or museums and you can frequently find pay-what-you-can events in your city. Check online to see what’s happening.

Photo by Pauline Loroy on Unsplash

Photo by Pauline Loroy on Unsplash

12. Set Goals

Saving is just one piece of the puzzle—financial goals go a long way to ensure you’re protected. Work with an advisor to learn more about how you can save, whether it’s through investments or a long-term plan.

Photo by CardMapr.nl on Unsplash

Photo by CardMapr.nl on Unsplash

13. Say No More Often

You don’t need that impulse item by the register. You don’t need a wardrobe every season. Train your brain to say no more often, which frees your home of clutter and your wallet of receipts.

Photo by Brooke Cagle on Unsplash

Photo by Brooke Cagle on Unsplash

14. Other Transportation

You may not want to cycle to work every day, or cram onto a bus, but you can always carpool. Assuming you get along with your coworkers, organize a carpool to save gas money and prevent mileage.

15. Unplug Devices

Believe it or not, plugged-in devices zap more energy than you think. Whenever you’re not using a device, get into the habit of unplugging them—you may be surprised at just how much comes off your electric bill.

Photo by Brett Jordan on Unsplash

Photo by Brett Jordan on Unsplash

16. Work on Debt

Work on debt as often as you can. Student loans, mortgages, and credit card debt accrue interest over time and stick you in an even deeper hole. Speak with your financial advisor to put an action plan together. Even if it’s little by little, it’s something!

Photo by Towfiqu barbhuiya on Unsplash

Photo by Towfiqu barbhuiya on Unsplash

17. Track Expenses

Track spending with an app or good ol’ pen and paper. Writing expenses down gives you a better idea of how much you spent and where, which helps make necessary cuts in the future.

Photo by Towfiqu barbhuiya on Unsplash

Photo by Towfiqu barbhuiya on Unsplash

18. Switch it Up

Bank fees and phone bills are two huge areas of opportunity. Compare companies to see if you can score a better deal, or find something that makes more sense for you.

Photo by Francisco Venâncio on Unsplash

Photo by Francisco Venâncio on Unsplash

19. Hop on Sales

Browse flyers to learn more about upcoming sales. Don’t be afraid to shop when you see a good deal, and don’t delay either. You may find coupons in flyers as well!

Photo by Daniel Thomas on Unsplash

Photo by Daniel Thomas on Unsplash

20. Wait 24 Hours

Nip online shopping in the bud with the 24-hour rule. Leave items in your cart for at least 24 hours so you can think about it some more. You may find yourself leaving more stuff behind.